European companies are falling far short of developing credible climate transition plans to align with a 1.5°C, nature-positive future, according to analysis of companies representing around 75% of European stock markets published today by non-profit CDP and global management consulting firm Oliver Wyman – a business of Marsh McLennan.

In a sign that European companies are becoming aware that such plans are needed, Stepping up finds around half (49%) now report having a climate transition plan in place to limit warming to 1.5°C.

However, the study finds most plans may lack ambition and transparency in key areas necessary to show serious action, such as in governance, financial planning, and value chain engagement.

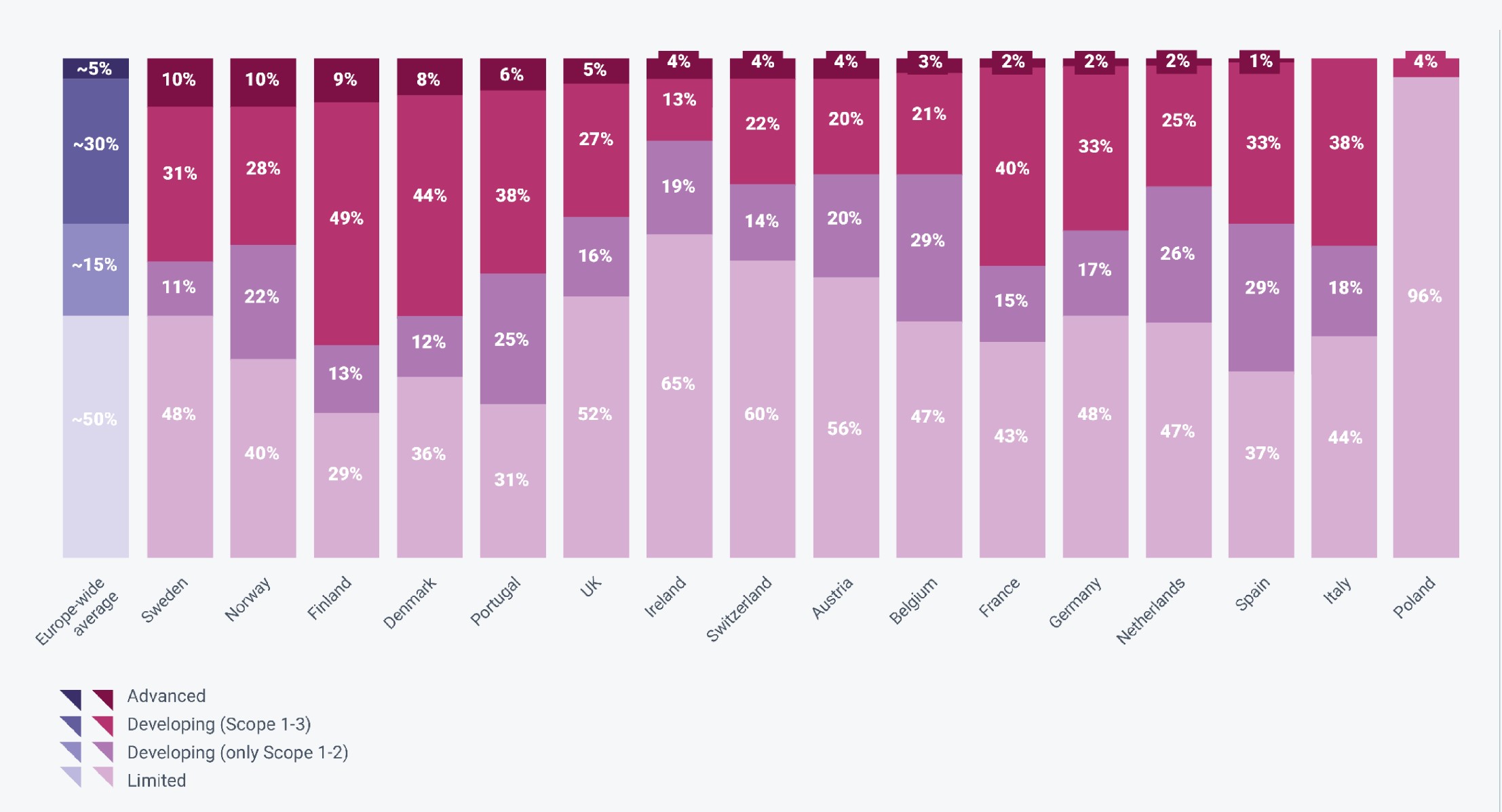

Under 5% of companies (56) have both a 1.5°C-aligned emissions reduction target and disclose against most (two thirds) of the key indicators that show a credible transition plan exists.[2]

A further 30-45% of companies are considered ‘developing’ – meaning they have less-ambitious (2°C-aligned) emissions goals in place and disclose against at least half of the indicators.[3] The majority of companies showed ‘limited’ progress.

Though 9 in 10 have initiatives to cut emissions, the report also finds clear action gaps in actions needed to transition to a 1.5°C path. For example, just 26% assess how far spending or revenue aligns with 1.5°C targets, and fewer than 40% are building climate concerns into supplier contacts.

As a result, the report estimates that up to 40% of all outstanding corporate debt of the companies analyzed (€1.8 trillion) currently finances those without clear targets or evidence of developing credible transition plans. Access to financing may become more challenging as banks look to hit net-zero goals by decarbonizing their loan books.

8 in 10 financial institutions disclosing to CDP are already assessing their corporate clients’ 1.5°C alignment in at least some key sectors.

And with climate just one part of a wider, nature-related challenge, the report also looked at key action areas across biodiversity, deforestation and water security. Just 7% of companies reported a strong target to reduce emissions, water consumption and deforestation, while 39% disclosed a public biodiversity commitment in place.

Incentivizing corporate executives to achieve goals is also lacking: 54% of companies now link exec-level pay to climate, with under a third doing so across climate change, deforestation and water topics.

More positively, and ahead of the European Union’s landmark mandatory reporting law (the CSRD) coming into place in 2024, 71% of companies disclosing climate change, deforestation and water security data to CDP already report this data in their annual management report for investors. On biodiversity that drops, however, to 1 in 4 companies.

Meanwhile around one in five companies were found to have a ‘best-practice’ policy in place to reduce water impacts, and 29% of companies a best-practice policy for no-deforestation.

Only 5% of companies reporting data on forests to CDP currently certify 90% of commodity volumes are deforestation-free, while just 13% assess the impact of their value chain on biodiversity.

Maxfield Weiss, Executive Director at CDP, said: “Every company that impacts our environment needs not only clear targets – but clear plans to deliver and evidence they are doing so. EU regulation will soon bite – it will be the law for companies to have clear plans that transition their business models onto a 1.5 °C footing. This report reveals only a tiny cohort of under 5% disclose all the data we need to judge. And climate is of course just one component of companies’ broader challenge. As expectations grow for companies to include nature in their broader transition planning, this report shows most companies still need to step up, and show investors, lenders and regulators that they are ready to act. Companies cannot reach net-zero without tackling their nature impacts: we don’t have time to waste.”

Cornelia Neumann, Partner at Oliver Wyman, said: “We need to see a step change in the scope and quality of European companies’ transition plans in the next 2-3 years. Our analysis with CDP shows that, while there is progress in the adoption of transition strategies, a higher sense of urgency is required. Many transition plans still lack important elements, especially when it comes to translating strategic climate targets into concrete implementation and value chain engagement plans. This level of concreteness is necessary if companies want to be able to steer their business through the transition and credibly demonstrate to their stakeholders that they are on track to meet climate targets. Companies with an ambition to lead in the transition will need to go beyond climate and incorporate their commitments on biodiversity and nature into their transition agenda.”

Download the full report (pdf)

Notes:

[1] The Corporate Sustainability Due Diligence Directive and proposed EU sustainability reporting standard ESRS for use under the Corporate Sustainability Reporting Directive (ESRS E1) will require companies to disclose 1.5 transition plans.

[2] The 21 key indicators found in CDP climate change questionnaire that denote a credible climate transition plan can be found here.

[3] Ranges are provided to account for analysis of emissions reduction targets considering either Scope 1 and 2 emissions only, or a company’s full value chain (Scope 1-3). On a Scope 1-3 basis, 30% of companies are ‘developing’ and 65% are ‘limited’.