A group of leading global investors has written to 36 of Europe’s largest companies through the Institutional Investors Group on Climate Change (IIGCC), to call on firms to properly reflect the implications of global commitments to limit temperature increases to well below 2°C, and ideally to 1.5°C, in their financial statements. The companies also receive a copy of ‘Investor Expectations for Paris-aligned Accounts’ published today by IIGCC, setting out more detail on the steps investors require companies to take on the issue.

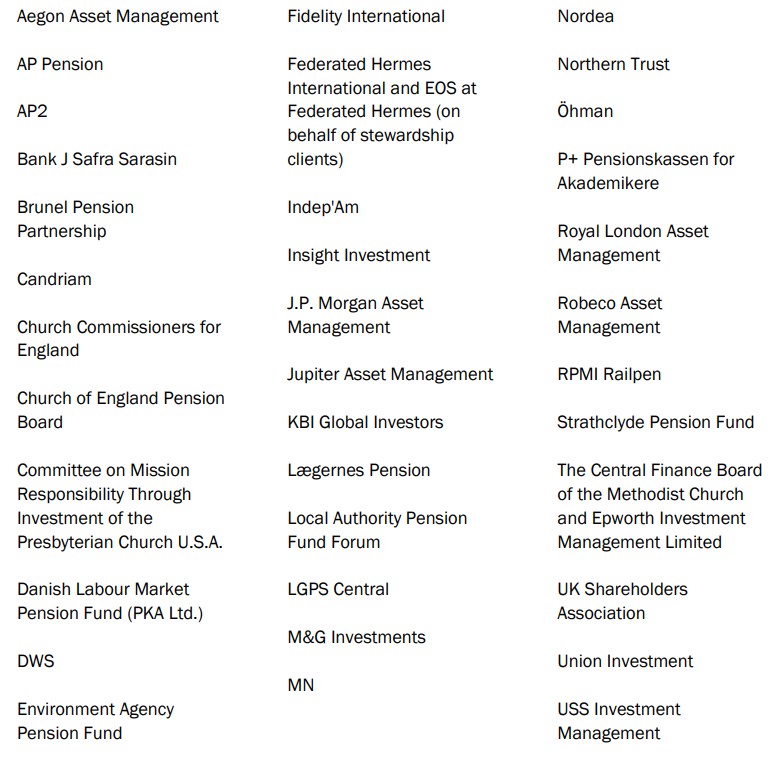

The 38 investor signatories to the letter collectively represent $9.3 trillion in assets under management or advice, underscoring the growing significance of the issue for the sector. This includes global investors such as DWS, the International business of Federated Hermes, Aegon Asset Management, Nordea, Northern Trust, the UK’s Local Authority Pension Fund Forum, the Church of England pension funds, and numerous others, with the letter authored by Sarasin & Partners LLP. IIGCC is the European membership body for investor collaboration on climate change and has more than 250 members, mainly pension funds and asset managers, with over €33 trillion in assets under management.

Companies receiving the letter were selected due to their exposure to decarbonisation risks, as economies transition away from fossil fuels in line with the Paris Agreement on climate change. This includes the largest listed European firms by revenue across the energy, transport and materials sectors. A few examples include, Anglo American, BASF, BMW, BP, Deutsche Lufthansa, EDF and Shell, among numerous others. The companies have a total combined value of $1.7 trillion by market capitalisation and combined revenues of $3.2 trillion and are among Europe’s largest companies.

“Companies can no longer afford to ignore what climate change means for their business. Investors need financial impacts of getting onto a net zero pathway to be booked and acted on,” explains Stephanie Pfeifer, CEO, Institutional Investors Group on Climate Change. “Climate change is material and the importance of alignment with the Paris Agreement is beyond doubt, what investors now need is visibility from companies in their accounts. They are making this clear today and expect companies to report in line with existing global accounting standards.”

The Investor Expectations set out five clear steps investors expect companies to take in preparing ‘Paris aligned’ company accounts3. It also, outlines specific investor expectations for auditors to call out where accounts are ignoring material climate risks; making it clear they should say when accounts are not ‘Paris-aligned’. This is the term used to capture the significance of ensuring the financial implications of ensuring global temperature rises are limited at 1.5°C – as set out in Paris Agreement – are fully reflected in financial statements.

Where these expectations are not met, three courses of investor action are identified: engagement, voting and divestment. Audit Committee directors and auditors are specifically identified to be held accountable for delivering on the investor expectations. As the letter explains, “…accounts are key to how capital is deployed by management as well as investors. If the accounts leave out material climate risks, too much capital will go towards activities that put shareholder capital at risk. Worse still, this puts all our futures at risk.”

“We are at a crossroads in our battle against climate change. Either we get serious and start shifting capital flows towards activities aligned with the Paris Agreement, or we continue to talk about it,” adds the author of the Investor Expectations, Natasha Landell-Mills, Head of Stewardship, Sarasin and Partners LLP. “Paris-aligned accounts are amongst the most important changes that will drive system-wide capital redeployment. Put simply, we need Paris-aligned accounts to drive Paris-aligned behaviour, thereby protecting capital for all. This is hopefully something that all companies and their shareholders can coalesce around.”

“Addressing climate change is an urgent matter, and one that must be addressed with action,” explains Brunno Maradei, Global Head of Responsible Investment, Aegon Asset Management. “Ensuring that the Paris Agreement is considered in financial statements is one way to ensure that the firms most exposed to carbon will be held truly accountable against this important global commitment, while also protecting long-term value for investors.”

“Investment opportunities in the renewable sector are a route to achieving zero emissions,” adds Cllr Doug McMurdo, Chair of the Local Authorities Pension Fund Forum. “But, the issues for fossil fuel companies include the crystallisation of reclamation and decommissioning liabilities, and worst case stranded assets. Given that markets are forward looking, the impact on many balance sheets will become very apparent, now and in the near future.”

“Assets, profits, liabilities and losses – solid financial accounts need to reflect all material information,” said Dr Henrik Pontzen, Head of ESG, Union Investment. “Climate change is real. The costs of climate change are material. Financial accounts that do not reflect the costs of climate change are thus incomplete. In view of this we expect all companies to thoroughly examine their financial accounting practices.”

“Investors expect corporate strategy and capex to be aligned to the Paris Goals and this must be supported by Paris-aligned accounts,” added Bruce Duguid, Head of Stewardship at EOS, Federated Hermes. “This will be critical to investors managing climate-related financial risks as well as shifting capital to avoid the worst impacts of climate change. This report sets out clear expectations of both board directors and auditors and we will be reviewing 2020 annual accounts for clear evidence of their response.”

The ability for companies to act swiftly has been powerfully demonstrated in the oil and gas sector by BP, Royal Dutch Shell and Total, which following investor engagement led by Sarasin & Partners, all reviewed their 2019 accounts in light of the Paris Agreement and the accelerating energy transition4. All three adjusted critical accounting judgements, resulting in material impairments. In June, BP went further and announced write-downs of between $13 and $17.5 billion, primarily attributed to an accelerated shift away from fossil fuels.

In September, IIGCC joined other investor groups, as a signatory to an open letter highlighting the significance of new guidance from the International Accounting Standards Board (IASB), clarifying the importance of reflecting climate-related risks in financial reports5. The IASB sets International Financial Reporting Standards used globally, and the published guidance removes any doubt on the existing requirements to include material climate risks in accounts.