Perceptions stick: a majority of people today seem to believe that we cannot afford renewable energy. This notion would suggest that the alternative – maintaining the existing fossil energy infrastructure – is cheap. Or at least less expensive in comparison. However, a look at the data shows

- Due to the lack of a meaningful competition, fossil energy enjoys a monopolistic market position, i.e. we have to pay whatever the cost. We can’t buy an alternative product

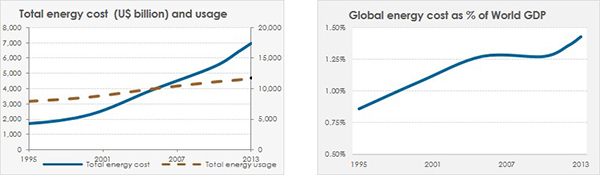

- As a consequence, total global expenditure for energy rose from 0.86% in 1995 to 1.43% of World GDP in 2013.

- The opportunity cost of maintaining the oil infrastructure – i.e. the cost of not having a renewable energy infrastructre – is US$ 2’778 billion in 2013.

Total global expenditure for energy rose significantly faster than global energy consumption over the past 20 years due to rising cost of fossil fuels. (Data: BP, IMF, World Bank)

As we move to more challenging locations to extract the remaining fossil resources – the arctic, deep under the ocean bed, cooking tar sands and fracking rock deep under the surface – exploration is becoming increasingly expensive. At the same time, the cost of renewable energy is dropping with technology development and mass production. Cost reduction is a function of investment volume (the higher the investments, the faster the cost reduction). An interesting question is therefore – what would happen if we decided to kick-start a renewable transformation now?

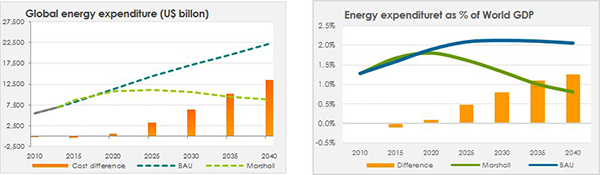

Comparative analysis of two different scenario, a business-as-usual scenario based on BP’s Energy Outlook to 2030, and a Renewable Energy Marshall Plan scenario, shows:

- Renewable energy is fast becoming cost competitive, and in some cases (wind power) already cheaper than fossil alternatives.

- Renewable energy cost of other technologies, including storage, could be reduced drastically with economics of scale (investment-induced mass production and deployment)

- At the same time, fossil energy carriers have to be extracted from more challenging locations (tar sands, ultra-deep sea, fracking, arctic drilling, etc.), i.e. costs of fossil fuels are rising.

- Not investing in large-scale renewable energy development and infrastructure NOW will cost us and additional US$ 500 billion in 2020, in excess of US$ 3’000 billion by 2025, and more thereafter. Every single year.

Global expenditure for energy needs is rising further in the future in line with increasing demand and rising cost of fossil energy extraction. However, if we abandon current policies favoring the fossil and nuclear industries in favor of renewables, coupled with strategic technology development and deployment, global energy expenditure would start to drop after 2020. By 2040, a renewable Energy Marshall Plan would save us 1% of World GDP compared to a Business-as-usual approach.

Remember the Stern Report that suggested it would cost us 1% of World GDP to avoid climate change? Sterns was wrong. It will cost us 1% of global GDP every year to maintain the status quo –before subsidies, and before starting to consider the cost of actual impacts of climate change and increasing extreme weather events. We cannot afford maintaining the out-dated fossil-based energy infrastructure.

Download the Report: The Cost of the Fossil Energy Infrastructure vs. A Renewable Energy Framework (PDF, 32 pages, 2 MB)